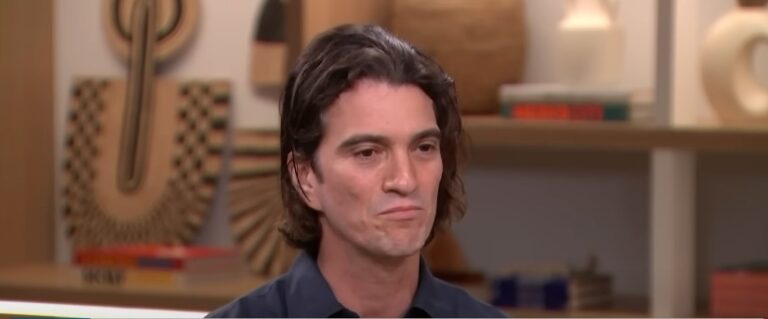

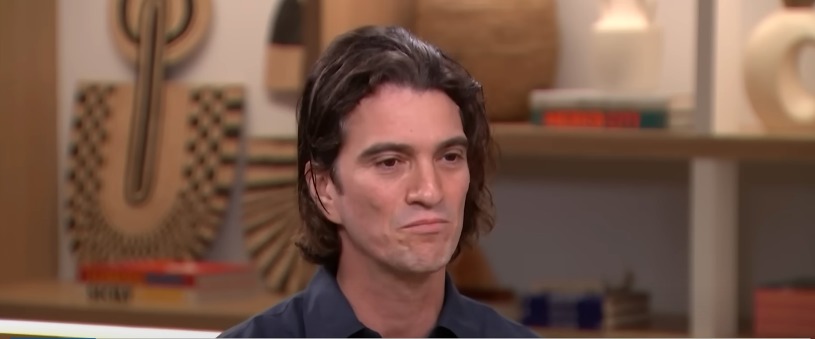

Extreme highs, heartbreaking lows, and surprising resiliency characterize Adam Neumann’s journey from the successful businessman behind WeWork to his spectacular fall and subsequent comeback. Neumann, who rose to becoming a billionaire through the quick ascent of WeWork, is well-known for his charisma and innovative approach to co-working spaces. However, a string of financial blunders and his time at the company caused a sharp decline, with WeWork’s valuation falling from $47 billion to less than $10 billion. With an estimated net worth of $2.2 billion as of 2024, Neumann has made a remarkable recovery from a career that was once dismissed as an example of caution in entrepreneurship.

Neumann’s ability to overcome these obstacles is evidence of his steadfast fortitude and flexibility when called upon. His story serves as an example of how quick success coupled with careless business tactics can result in both a substantial fortune and an equally noteworthy decline in reputation. But as of right now, Neumann’s financial skills are still strong, and new business endeavors in the technology and real estate industries are assisting in the reconstruction of his fortune. His capacity for self-reinvention contrasts sharply with the course that many had anticipated for him following WeWork’s disastrous initial public offering.

| Category | Details |

|---|---|

| Full Name | Adam Neumann |

| Date of Birth | April 25, 1979 |

| Nationality | Israeli-American |

| Profession | Entrepreneur, CEO, Real Estate Investor |

| Net Worth | $2.2 billion (as of February 2024) |

| Company Founded | WeWork (2010) |

| Key Ventures | WeWork, Flow, Flowcarbon |

| Investors | SoftBank, Andreessen Horowitz, Goldman Sachs |

| Notable Assets | Miami real estate portfolio, SPAC shares in WeWork |

| Spouse | Rebekah Paltrow Neumann |

| Children | Six |

| Reference | Forbes – Adam Neumann Profile |

In 2010, Neumann started his business career by co-founding WeWork, a shared workspace company that aims to foster a sense of community among large corporations, startups, and independent contractors. His vision and charismatic leadership helped WeWork rapidly expand into a multinational corporation. The business’s valuation skyrocketed as investors dumped money into it. Neumann’s personal stake in WeWork was worth more than $4 billion by 2018, when the company was valued at an astounding $47 billion. But as the business grew, the flaws became apparent. Concerns were raised by excessive spending, excess expansion, and Neumann’s own management style, which was frequently extravagant and unpredictable.

WeWork’s 2019 IPO filing served as the tipping point. Reports of high debt levels, dubious business practices, and a leadership team perceived as unduly preoccupied with Neumann’s personal interests raised doubts about the company’s financials. The initial IPO valuation of $80 billion for WeWork was swiftly reduced. The company was only worth $8 billion when it went public in 2021 through a Special Purpose Acquisition Company (SPAC). However, despite the company’s decline, Neumann had already secured his fortune by cashing out hundreds of millions from the sale of his personal stock.

Following the incident, Neumann was the target of legal action and public criticism, with some questioned the morality of his behavior. Particularly contentious was his “golden parachute” deal, which gave him $700 million after he resigned as CEO. The payout demonstrated Neumann’s ability to maintain substantial wealth and influence even after his tenure as WeWork’s leader came to an end, even though many people thought it was excessive considering the company’s demise. Nevertheless, Neumann’s financial trajectory continued after the fallout.

After leaving WeWork, Neumann turned his attention to real estate investments, especially in the Miami area. He established Flow, a residential real estate business, in 2022, and the venture capital firm Andreessen Horowitz invested $350 million in it. This action marked Neumann’s strategic change from co-working spaces to luxury real estate investments, which enabled him to profit from the booming real estate market. Furthermore, Neumann’s entry into the carbon credit trading market through his startup Flowcarbon demonstrated his ongoing innovation in developing markets and strengthened his reputation as a reinvention-capable entrepreneur.

According to Forbes, Neumann’s net worth was $2.2 billion as of February 2024. His calculated move into real estate, where Miami’s high demand for residential real estate and Neumann’s well-known investments have produced significant returns, helped facilitate this incredible recovery. His investments in tangible assets and innovative startups have restored his personal wealth, which was previously in jeopardy due to WeWork’s demise.

Neumann’s lifestyle still reflects his wealth in terms of personal assets. At one point, he and his spouse, Rebekah Paltrow Neumann, had a real estate holding worth over $90 million, which included homes in the Hamptons, the Bay Area, and New York. Even though some of these properties have been sold, Neumann is still making wise purchases, such as this $44 million property in Miami Beach. In addition to being a wise financial decision, his continued involvement in luxury real estate shows that he is still wealthy and influential despite WeWork’s disastrous demise.

But even with his remarkable comeback, Neumann’s prior behavior is still being questioned. Many have questioned his business practices as a result of his extravagant spending and the scandal surrounding the WeWork IPO. His connections with SoftBank, which resulted in the company investing billions of dollars in WeWork, is still a source of contention. Neumann has maintained his prominence in the business world in spite of these obstacles. His current business endeavors, such as Flow and Flowcarbon, indicate that Neumann is far from done being an entrepreneur.